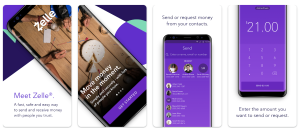

Mobile payment applications and peer-to-peer (P2P) payment technologies send money simpler and faster to many. It also allows small companies to pay vendors or get paid by their consumers. Zelle, like PayPal, Venmo, and other popular mobile payment choices, is a peer-to-peer payment system that allows you to move money faster, receive payments from friends, and handle small business invoices more effectively, with no costs. Here’s an in-depth look at what is zelle and how it may help you better your financial situation.

What exactly is Zelle?

Do you know what is zelle? Early Warning Services, situated in Scottsdale, Arizona, established Zelle in 2016. Its peer-to-peer (P2P) and business-to-business (B2B) mobile services in the United States enable users to send and receive funds using just the recipient’s mobile phone number or email address. Zelle has connections with almost 500 financial institutions. However, for your business to utilize Zelle, your banking institution must provide it as a business account type choice. Anyone may use Zelle’s unique P2P service through their bank or the cell app.

Zelle assists companies and consumers in reducing the need for paper checks and cash transactions. Mobile transactions allow for fast payments, and Zelle can immediately remind clients who have yet to pay. With sustained small company growth and increased consumer usage, Zelle will have exchanged hundreds of billions of dollars in 2021 alone.

How does a Zelle function?

Money transmitted using mobile, unlike other applications, is transferred straight from one bank account to another. Most inter-account bank transfers require account numbers to commence transactions, which might take several business days to complete. Zelle bypasses this requirement by allowing consumers to transfer cash in minutes from one checking account to another. All you need to start a transfer is the recipient’s email address or phone number. Zelle notifies the receiver through text message or email that a payment is on its way, along with a link to accept it.

If the receiver’s bank is a participating partner, the recipient only has to sign up for the service using an email address or phone number on their bank’s website or mobile app. After registering, the receiver can make money, albeit new users may have to wait up to three days. You can still receive money if the recipient’s bank is not a participating member by installing the cell mobile app, registering with an email address or phone number, and inserting a debit card.

Is Zelle safe?

Zelle is typical to be a safer way to transmit money. It is because phone transactions do not necessitate sensitive financial information. Furthermore, to guarantee that you are the one approving mobile payments, your bank or credit union must have identification and auditing capabilities. Zelle is quick, easy, and free and functions similarly to currency. However, because Zelle is free, it does not provide the same payment safety that users expect from a credit or debit card that protects people from fraudulent charges. For these reasons, you should only use Zelle to pay individuals you know and trust: friends, relatives, and a few trustworthy small company owners.