|

|

| Rating: 4 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Early Warning Services, LLC |

The Zelle App is a popular peer-to-peer payment service that enables users to send and receive money securely and conveniently. With over hundreds of participating banks and credit unions in the United States, Zelle provides a seamless platform for individuals to transfer funds directly from their bank accounts using their mobile devices. By leveraging the existing infrastructure of financial institutions, Zelle offers a trusted and efficient way to make payments, split expenses, and send money to friends, family, or acquaintances.

Zelle’s user-friendly interface and wide network of participating banks make it a convenient choice for users looking for a simple and direct payment solution. Unlike traditional payment methods, such as checks or cash, Zelle enables instant transfers, eliminating the need for physical exchange and offering a faster and more efficient way to handle financial transactions. With its widespread adoption and focus on security and convenience, Zelle has become a preferred option for many individuals seeking a reliable peer-to-peer payment service.

Features & Benefits

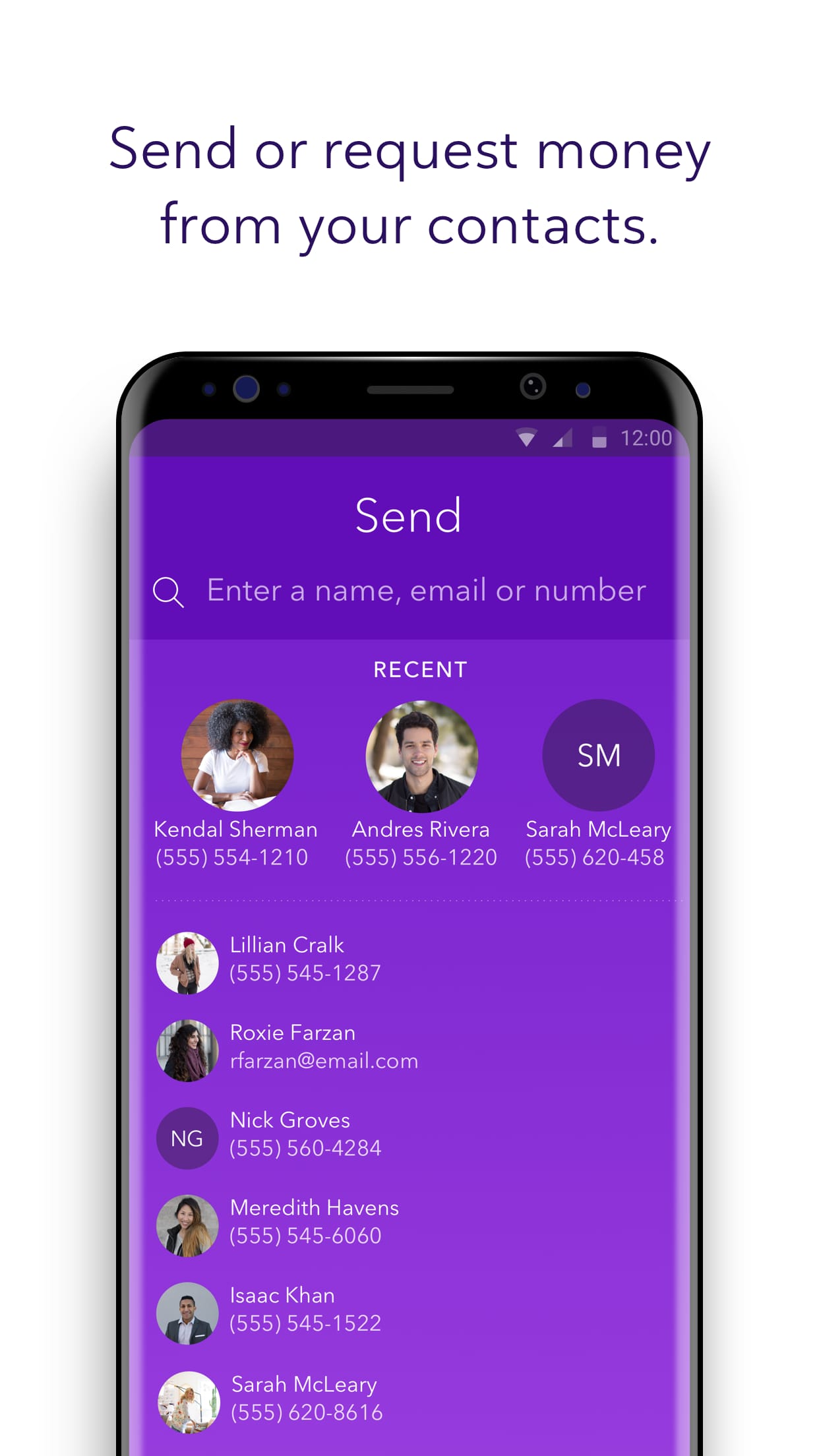

- Direct Bank Transfers: Zelle allows users to send money directly from their bank accounts to recipients within the Zelle network. This eliminates the need for third-party intermediaries and ensures quick and hassle-free transfers.

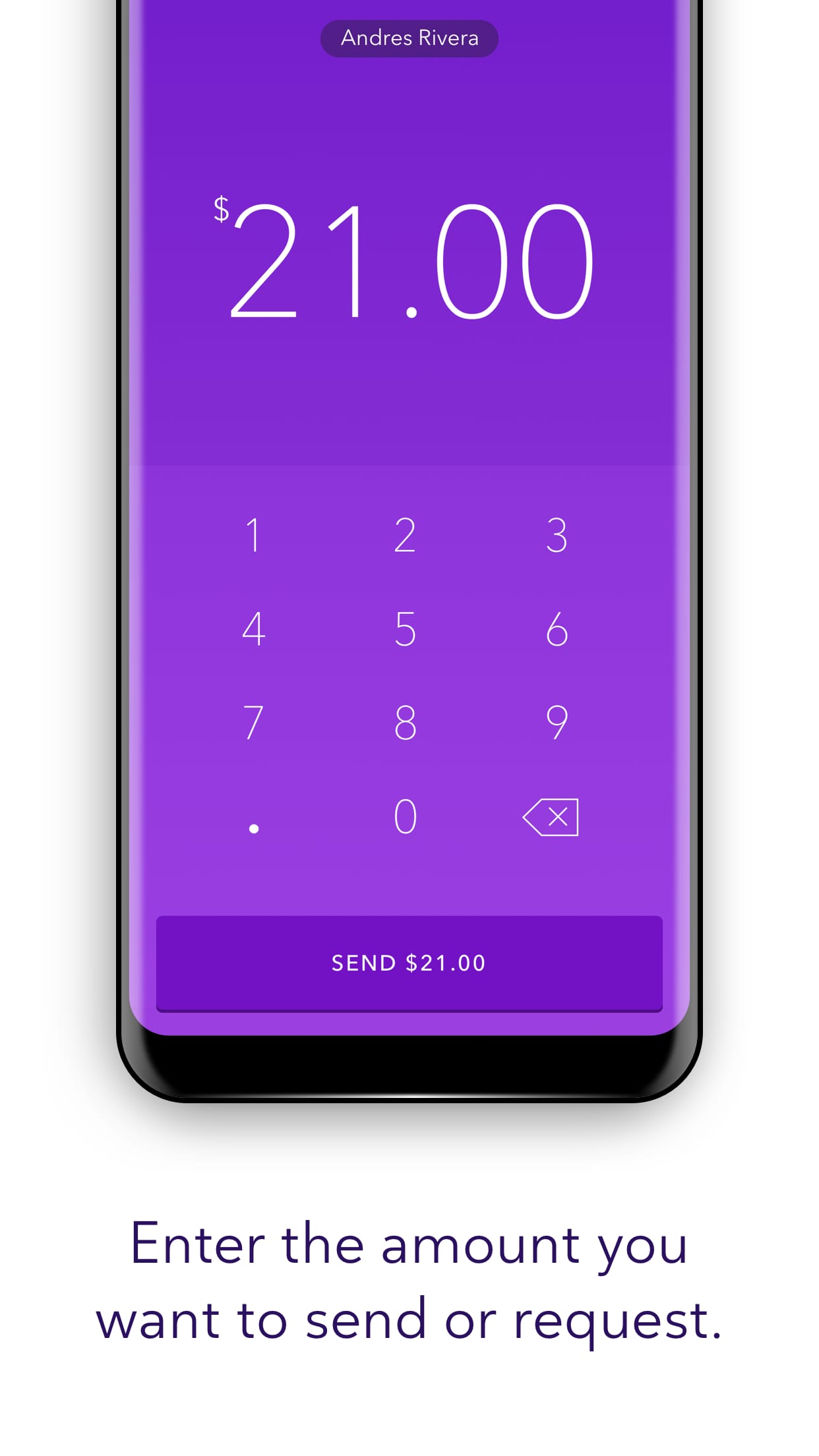

- Instant Transfers: With Zelle, users can enjoy near-instantaneous transfers, enabling recipients to access the funds almost immediately. This feature is particularly useful when urgency is required, such as splitting bills or sending emergency funds.

- Wide Network of Participating Banks: Zelle has established partnerships with numerous banks and credit unions across the United States, making it accessible to a large user base. This wide network ensures that many individuals can easily send and receive money using the app.

- Simplified Splitting of Expenses: Zelle simplifies the process of splitting bills and expenses among friends or groups. Users can easily divide costs and send individual payments, eliminating the hassle of collecting and reconciling funds manually.

- Enhanced Security Measures: Zelle prioritizes security and employs advanced encryption protocols to protect users’ financial information. With its integration within participating banks, Zelle leverages the existing security measures of these institutions, providing an added layer of trust and protection.

Pros

- Quick and Convenient Transfers: Zelle offers fast and hassle-free money transfers between bank accounts, providing a convenient solution for users who need to send or receive funds promptly.

- Extensive Bank Network: The app’s partnership with numerous banks and financial institutions ensures widespread availability, allowing a large user base to access its services.

- Real-Time Transactions: Zelle’s real-time transaction feature enables instant money transfers, making it ideal for time-sensitive payments or emergencies.

- High Level of Security: Zelle prioritizes user security and employs advanced encryption technology to protect sensitive financial data, ensuring safe transactions.

- Effortless Bill Splitting: The app simplifies the process of splitting bills among friends or family members, allowing users to divide expenses and request payments seamlessly.

Cons

- Limited International Availability: Zelle is primarily available within the United States, which restricts its usage for individuals residing in other countries or for international transactions.

- Dependent on Bank Partners: The availability and functionality of Zelle may vary depending on the user’s bank. Some banks may have limitations or specific requirements for using Zelle, which can affect the user experience.

- No Standalone Account: Zelle does not provide a standalone account; instead, it relies on users connecting their existing bank accounts. This may be inconvenient for users who prefer a separate account for their transactions.

- Transaction Limits: Zelle imposes transaction limits, which may restrict the amount of money that can be sent or received within a specific time frame. Users should be aware of these limits when using the app.

- Lack of Payment Protection: Unlike some other payment apps, Zelle does not offer buyer or seller protection for transactions. Users should exercise caution when making payments to unfamiliar individuals or for online purchases.

Apps Like Zelle

Google Pay: Google Pay enables users to send money, make online purchases, and even pay in physical stores using their smartphones. It offers loyalty rewards and integrates with Google’s ecosystem of services.

Apple Pay: Apple Pay allows iPhone and Apple Watch users to make secure payments using their devices. It supports in-store, online, and peer-to-peer transactions, and offers a seamless and convenient payment experience.

Facebook Pay: Facebook Pay, integrated within the Facebook app, allows users to send money to friends, make donations, and even make purchases through Facebook Marketplace. It offers a social platform for financial transactions.

Screenshots

|

|

|

|

Conclusion

In conclusion, the Zelle App offers a convenient and secure platform for peer-to-peer payments. With its direct bank integration, wide network of participating banks, and near-instant transfers, Zelle simplifies the process of sending and receiving money. The app’s emphasis on security and its integration with existing financial institutions provide users with peace of mind when conducting transactions.

While Zelle has limitations such as its limited international availability and dependence on bank participation, its benefits, including simplified expense splitting and enhanced security features, make it a popular choice among users. With positive user reviews highlighting its convenience and speed, Zelle continues to be a preferred option for individuals seeking a seamless and reliable peer-to-peer payment service.